Feeling lost with long list of your finances? You’re not alone as many of us struggle to understand where our money goes, leading to financial stress. But there are simple strategies to gain control of your personal finances to make your life stress free and clear up your dues like a pro.

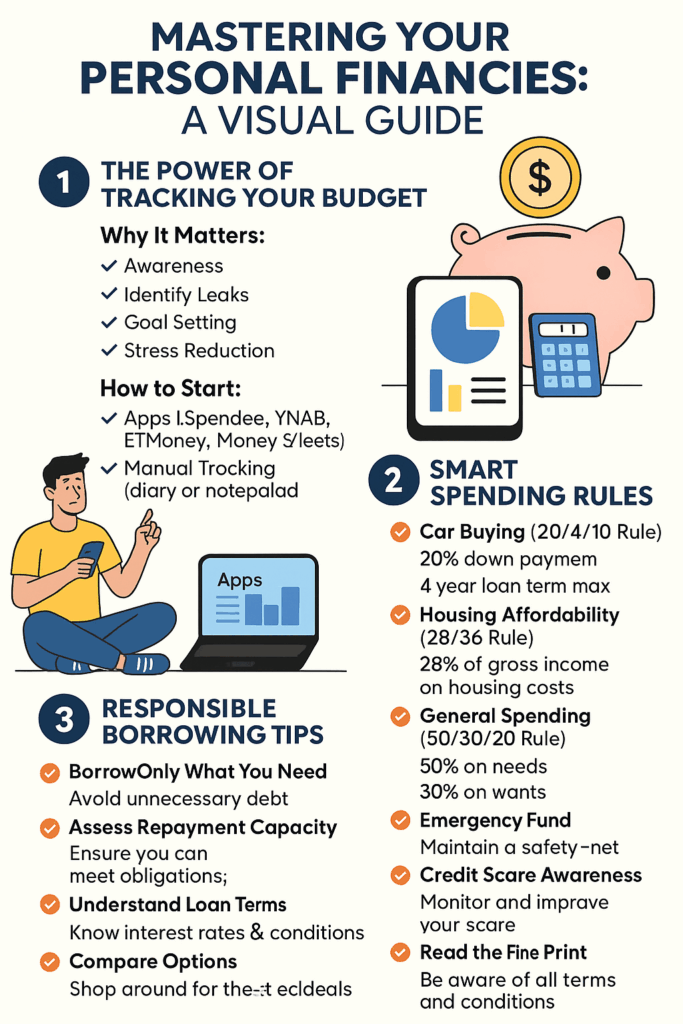

1. What is Budget Tracking ?

Budget Tracking is the best way to manage your personal finances as you can understand where you spend by Tracking your budget and spends both. Instead of guessing you can know better and exact values rather than just estimates to clearly see the spends. Tracking your spending is the foundation of financial clarity.

Why Tracking Finances Matters

- Helps create awareness to create budget with accuracy

- You can identify your spending leaks to avoid unnecessary spending

- Set goals to buy things within your budget in future if you cannot buy something now

- Reduces stress as you don’t need to worry of unknown spendings you may have forgot, even if you know, the correct money you spent

How to Start Tracking Finances

- Using apps like Spendee, YNAB, ETMoney, MoneyView

- If you are old school Using a Spreadsheet program like MS Excel is a good way to track as you can apply calculations as well

- Or just a handy notepad or a diary to write down daily expenses and track weekly or monthly

- You need to Categorize your spends and then review at regular times to keep your Budget in place

A Pro Tip is to don’t just judge something but adjusting spending and budgeting, there is no hard fast rule so feel free to adjust regularly to see changes. Based on the timely data, you can better plan your personal finances and improve your spending budget to live stress free.

2. Buying Rules for Smart Spending

Making large purchases can significantly impact your financial health. Here are some guidelines to decide how much to spend when you buy something and keep your finances on track using Buying Rules; so, can enjoy buying instead of regretting. Spending rules are just methods by finance experts to help you make buying decisions for long term loan based products like car financing or home loans. Some examples Buying rules are listed below to help you understand rules when buying a house or a car.

Car Buying (20/4/10 Rule)

- 20% down payment that you can pay with your salary

- 4-year maximum loan term so you can pay it fast

- 10% of monthly income for total car expenses.

if you have 20% and 10% within your salary then it’s a nice fit to buy a car at that price, but going beyond this percent is not recommended.

Housing Affordability (28/36 Rule)

Affording a house is the dream of many people now a days. Everyone thinks of buying a large house with multiple rooms, high class society, garden, pool and more amenities.

- 28% of gross monthly income for housing costs.

- 36% of gross monthly income for total debt.

So, 65-70% should be the amount for buying a house. In short, if you earn 100,000 per month then the amount should be 65,000-70,000 for affording a house on loan.

General Spending (50/30/20 Rule)

- 50% of your monthly salary for needs.

- 30% for basic wants.

- 20% savings/debt repayment.

This is a rule that everyone can follow for a better budget irrelevant to their salary. This is also not fixed and can be adjusted as well as per needs.

Why Buying Rules Matter?

These rules help you avoid overspending and ensure your expenses align with your income. They provide a framework for responsible financial decisions to make you a responsible person who is a pro with personal finances. Things you need to consider:

- Personal Circumstances: Adjust rules to your situation as some rules may not be applicable based on your needs and finances available.

- Cost of Living: The cost of living is different for each city, each state and each country, so the rules can be changed a little. Experiment it.

- Financial Goals: Align spending with your goals. Regularly track and update your goals to have optimised rules.

- Emergency Fund: Build one before major purchases and don’t keep all your eggs in one basket, i.e. FD, Mutual Funds, Stocks, Crypto and more based on your risk factor

Risk Factor is a calculation value that helps you decide what you can spend on something so that it doesn’t affect you. Let say one person, earns 1,00,000 and another person earns only 10000, so if they both have to invest 5000, its like 5% for one person whereas 50% for another person. Obviously losing 50% is highly risky as its half the amount, whereas on other side, it does not matter as that is a small value of 5000. So, this is how you can calculate Risk while investing. Only invest those that you can risk in high investing schemes, and for low risk invest in low returns schemes that are safe.

Also Read Smart Ways to Invest your Money

Rules for Taking Loans

As we discussed the money and buying rules before, there is another thing as well that is needed to be understand. Loans and Debts are a part of everyone’s life nowadays because of the high costs of living and inflation. Plus, the availability of products on interest. People are taking more loans now. It’s crucial to approach loans with caution and a clear understanding of the implications. Do not sign any loan documents that you do not fully understand, read every clause carefully or take help of others who have knowledge of finances. Here’s a breakdown of essential rules to follow when considering taking on debt/loan:

By adhering to these rules, you can minimize the risks associated with borrowing and make informed financial decisions.

1. Borrow Only What You Need

Resist the temptation to borrow more than necessary as the debt can grow exponentially if you miss even one EMI payment. Excess borrowing leads to higher interest payments and increased financial burden so avoid that and only take what is necessary and your pocket allows it. Carefully assess your needs and calculate the precise amount required.

2. Assess Your Repayment Capacity

Before taking a loan, realistically evaluate your ability to repay it. Calculate your monthly income and expenses to determine a comfortable loan repayment amount. A general guideline is to keep your total monthly debt payments (including the new loan) within a reasonable percentage of your income. Make sure the total of EMIS should be less than 70% of your monthly salary, and less than 60% is good.

3. Understand the Loan Terms

Thoroughly read and understand the loan agreement carefully. Pay close attention to:

- Interest rates (fixed or variable) as they both offer different advantages.

- Repayment terms (loan duration, payment frequency). Try to keep it short term and don’t over stretch.

- Fees and charges (origination fees, prepayment penalties). Check if no unnecesarry fees is added.

- Any collateral requirements and security of collateral as you will be handing over your property docs.

4. Compare Loan Options

Don’t settle for the first loan offer you receive as you can always negotiate and get a better offer. Shop around and compare interest rates and terms from multiple lenders (banks, credit unions, online lenders). Use online loan comparison tools like bankbazar to streamline the process.

5. Consider the Purpose of the Loan

Distinguish between “good” debt and “bad” debt. “Good” debt (e.g., student loans, mortgages) may appreciate in value or contribute to long-term financial well-being whereas “Bad” debt (e.g., high-interest credit card debt) can quickly spiral out of control. Only take on loans for necessity and well thought out reasons like Education, health and necessity items like electronics, vehicles.

6. Build an Emergency Fund

Before taking on a loan, ensure you have a sufficient emergency fund to cover unexpected expenses atleast for 3 months in case you are not able to earn for 3 months. This will help you avoid relying on additional debt in case of financial hardship like job loss, business loss or any other financial troubles.

7. Credit Score Awareness

Know your credit score and maintain it, as a higher credit score will often result in better interest rates. Having a credit score of 750+ is mandatory for multiple finance institutions whereas 800+ gives you instant discount on credit for cheaper loans. Work to improve your credit score before applying for large loans to save on interest with cheaper loan rates, also to avoid application decline due to low credit score.

8. Read the fine print

Do not sign any loan documents that you do not fully understand. Check the conditions usually in small letters that banks add so people don’t look carefully. Check things like Charges on late payments, early loan closure, multiple payments and more.

Putting it All Together

Combine the power of tracking with smart buying rules. By understanding where your money goes and making informed purchasing decisions, you can build a solid financial foundation. Take control of your finances today. Start tracking, budget wisely, and buy smart. Your financial future will thank you.